James Rothschild Nicky Hilton. Have you ever pondered why some people seem to have money falling on them like confetti while others are left with nothing? A lot of the time, the difference isn’t picking stocks like a genius. It’s starting now. Like, before you know that jeans shouldn’t cost $200.

To start, picture money as a snowball at the top of a hill. It becomes bigger the longer it rolls. This isn’t magic; it’s adding up. You put in $100. It gets interest. You will get interest on both the original money and the money you made last year. In 30 years, that snowball might smash a car.

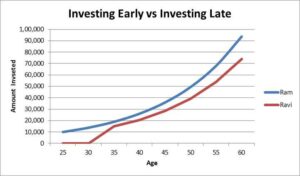

Let’s put this in context. A 22-year-old who puts $2,000 a year into an investment for ten years and then stops could have more money by age 65 than someone who waits until their thirties, puts $2,000 a year into an investment for 30 years straight, and never stops. Doesn’t that seem crazy? But when you add up the figures and allow compounding do its thing, people who start early often finish ahead of those who start late.

But money isn’t everything. If you start young, you can make mistakes and yet have time to fix them. You chose a bad mutual fund? No problem. You probably still live in your 20s and eat ramen. You can try again with less stress, which means less danger of a heart attack. Having time on your side gives you freedom. You don’t have to worry about “doing it wrong” as much because you have decades to get it perfect.

What more do you know? If you invest early, you might not feel as much pressure to go big. If you wait until you’re forty, you feel like you have to put a lot of money into the market just to catch up. When should you start? In your teens or twenties? Even small amounts can accomplish a lot of hard lifting. You are not running fast. You’re in it for the long haul.

Some people laugh and say, “That’s great if you have some extra cash.” But even if you’re short on cash, saving something—anything—can help. A little can turn into a lot, whether it’s the cost of your daily coffee (without the premium syrup) or some spare coin you found under the couch cushions.

Let’s not act like investing is all good news. Markets can be very unstable at times. If you start early, downturns won’t ruin your dreams. Dips are like sales at your favorite store, in fact. Are there any stocks on sale? If you can, pick them up. These difficult patches could be the fertilizer that helps your investment garden develop even faster if you have twenty, thirty, or forty years to go.

The final truth is painfully clear: Time is your best friend. If you put money in earlier, you won’t have to do as much work later. Your future self will thank you, presumably from a beach somewhere, with an umbrella drink in hand and no worries about the next payment. Investing early isn’t simply about money. It’s a way to take care of yourself. And a very strong one at that.